Funding Rate- A Quick Overview

Over the weekend, I've learnt a new concept in crypto- funding rate. It took me awhile to understand what this concept was, so I hope this article will be a finance beginner-friendly introduction to funding rates.

First- let's talk about perps

Before we can talk about funding rate, we need to first understand perpetual futures in crypto. Perpetual futures in crypto is very similar to futures in traditional finance- it is a contract that requires you to buy/sell an asset at an agreed upon price. This is often used in commodities, where producers and consumers can reduce their risk due to price fluctuations. Likewise, perpetual futures are a contract on a crypto asset. However, the main difference is that perpetual futures never expire.

What's the big deal if perpetuals do not expire?

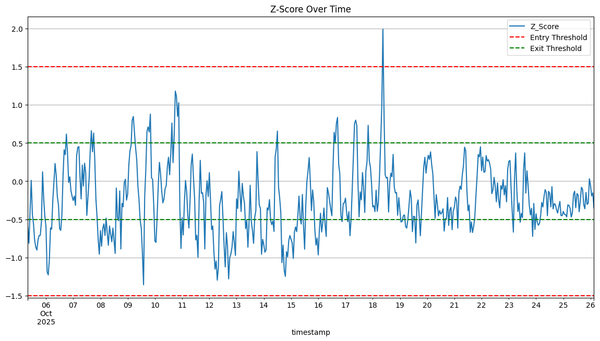

As perpetuals do not expire, it is important that we keep the perp price somewhat anchored to the spot price- which is to say, their price difference should not be too big. In order to facilitate such a mechanism, many exchanges implement the funding rate system.

A funding rate system is an agreement between the longs and shorts of an asset to pay each other.

Funding rate mechanism

Let's use BTC as an example. Suppose the current spot price is $100k and the current perp price is $105k. In other words, the market is bullish about the asset. In such a case, the longs have to pay the shorts a certain amount as determined by the funding rate. On most exchanges, this is around 0.01% to 0.03% per 8-hour period. This mechanism discourages further buying of the asset as there is a higher cost involved. This helps to minimise the spread between the spot and perp price.

Now suppose the spot price is $100k and the perp price is $95k. This implies that the market is pessimistic about BTC. In such a case, the shorts will have to pay the longs the funding rate to reduce further deviation between the spot and perp price.

So why not just hold the underlying asset?

You'll notice that when you own a perp, you have to pay a 'tax' (funding rate) to another person. Over time, this funding rate can add up to a lot. So why do we even have perps? There are a few reasons:

- Leverage: It is much cheaper to own perps than to purchase the underlying spot. In such a case, perpetuals can act as a form of leverage.

- Acts as an 'easier form of shorting'.

- No custody hassles.

So when should we not use perpetuals? Long term holders of an asset should buy the spot as opposed to buying perps- the annualised fees of funding rates are not worth it.

In practice, many sophisticated investors will own both spot and perps, and adjust their holdings accordingly to implement their strategy.